Purpose Led Property Investment

Property

with Purpose

Property

with Purpose

Property investment that helps

people and communities to thrive

Property

with Purpose

Property investment that

helps people & communities thrive

"We are building a new kind of property investment, one that delivers strong, sustainable returns for investors and creates real measurable impact in peoples lives."

Property Investment with Purpose,

At Cornwick, we believe property investment should do more than just generate great returns.

We create purpose-led property investments that directly support people and communities — delivering high-quality social housing and supported living solutions while providing investors with strong, stable, government-backed income.

1

Hands free - Fully Managed Solutions Our team manages everything from source, refurb and tennant management.

2

Short & Long Term Investment Options Designed around your goals

3

Security Against Property Assets

1st & 2nd charge available depending on investment level & term

4

Socially Aware Projects creating, Affordable Housing, Social Housing and Supportive Care

A Growing Need...

with a Smarter Way to Respond

The UK is facing a silent crisis, with growing demands for supportive care & quality social housing facilities to help the homeless, people with long term sickness or with learning disabilities and rehabilitation requirements.

We believe the answer lies in combining property development / investment expertise with the experience of social housing providers & CQC-approved care providers. A long term solution that supports the UK Infrastructure growth required.

A Growing Need...

with a Smarter Way to Respond

The UK is facing a silent crisis, with growing demands for supportive care & quality social housing facilities to help the homeless, people with long term sickness or with learning disabilities and rehabilitation requirements.

We believe the answer lies in combining property development / investment expertise with the experience of social housing providers & CQC-approved care providers. A long term solution that supports the UK Infrastructure growth required.

Why Investors

enjoy working with us

We make property investing simple, transparent, and tailored to your needs.

20+

Years experience in property - invest & delivery

7

Live projects with ever growing pipeline

£450k

Investment funds raised this year

95%

Of our Investors - Reinvest once their term is complete

How Our Process Works

We’ve made Property Investing simple, transparent, and stress-free — so you can focus on what matters most.

Step 1

Consultation call

Send through you contact info and we can arrange a 1-2-1 call to discuss you property goals and timeframes - No Obligation

Step 2

Align with Project & Goals

Our team matches your investment goals with suitable property projects - solution tailored to your needs.

Step 3

Fully managed solution

Once involved, we do all the heavy lifting, sourcing successful projects - managing the purchase, refurb and exit strategy.

Frequently Asked Questions

Clear answers to the questions we hear most from clients.

What is the typical investment amount?

Our loan agreements start from a minimum investment of £20,000, making property investment accessible to a wide range of investors. Many of our clients invest between £25,000 and £100,000, with returns structured on a tiered system—the larger your investment, the higher your annual return rate. We work with each investor to find an investment level that suits their financial goals and risk appetite

Do I need building experience?

Absolutely not. Our experienced team handles every aspect of the property development process, from initial acquisition through to final completion. You benefit from our 20 years of construction expertise and established network of trusted contractors without needing any building knowledge yourself. Your role is simply to invest—we take care of everything else.

How much time will this take to set up for me?

The setup process is designed to be straightforward and hassle-free. After your initial consultation, we handle all the legal documentation through our solicitors, with most agreements finalised within 2-3 weeks. Once invested, you can be as hands-on or hands-off as you prefer—many investors simply receive our regular progress updates and enjoy watching their investment grow.

What is the security on the money?

Your investment is protected through comprehensive legally structured loan agreements, with the option of personal guarantees and first /second charge security against the property where appropriate, meaning your investment is secured against a tangible asset. We are transparent and rigorous with our due diligence, and you can see the entire financial model before entering an agreement on a project.

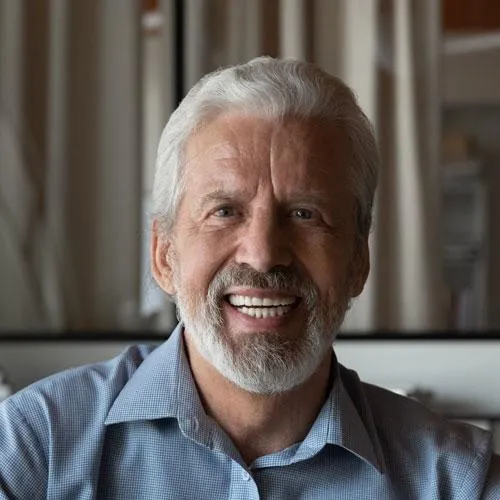

TESTIMONIALS

What others are saying

"Loved everything so far"

Partnering with CornWick on our first earn-and-learn project has been a great experience. Their trustworthy and straightforward approach gives us real confidence that our investment is in safe hands while we build our portfolio.

Paul & Caroline Baines

"Trasparency Throughout"

Outstanding experience from start to finish. The transparency throughout the refurbishment process was impressive, and the final returns exceeded expectations. I've already reinvested—this is property investment with real purpose and profit.

Greg - Investor / Developer

"Professional and Fun"

Mark and the Cornwick team delivered exactly what they promised. Professional service, regular updates, and excellent returns on my investment. It's reassuring to know my money is working hard whilst genuinely helping our local community

Debs - Investor

Our Compliance Is For Your Protection

Disclaimer: This communication is for informational purposes only and does not constitute an offer or solicitation to invest. Property investments carry risks, including potential loss of capital and illiquidity. Past performance is not indicative of future results. This investment opportunity is not regulated by the Financial Conduct Authority (FCA), and as such, investors will not have access to the Financial Services Compensation Scheme or the Financial Ombudsman Service. Prospective investors should seek independent financial advice to assess suitability.